What is a Contingency When Buying a Home in Chandler AZ?

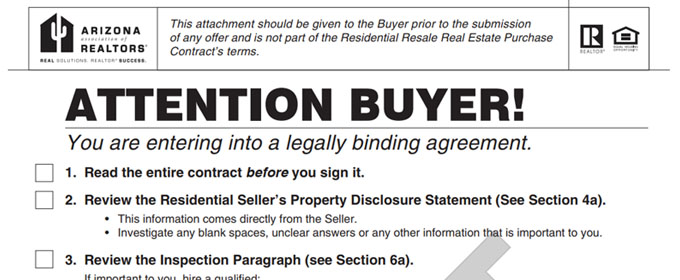

Is there any contingency after Buyer making offer on a house? These are the questions normally Buyer will ask. Think of the word “contingency” as akin to “if.” When a home buyer signs a contract agreeing to the purchase of a home, she is saying, “I agree to purchase this home in Chandler for this amount of money if…” The “if” is the contingency. Contingencies are those items that must come to pass before the sale finalizes. The list of possible contingencies is endless – you could tell a seller that you’ll purchase his home if his dog turns into a pig, sprouts wings and flies away. You could do that, although you probably wouldn’t get the house. Contingencies in a real estate contract also represent steps along the way that allow the buyer to back out of the deal without losing her earnest money deposit or incurring a lawsuit. Contingencies may be scattered throughout a contract. Let’s take a look at some of the more common real estate contract contingency when buying a home in Arizona.

Contingencies in a real estate contract also represent steps along the way that allow the buyer to back out of the deal without losing her earnest money deposit or incurring a lawsuit. Contingencies may be scattered throughout a contract. Let’s take a look at some of the more common real estate contract contingency when buying a home in Arizona.

Loan Approval

This is generally the first contingency listed in the contract. For instance, in the Arizona Association of Realtors® Residential Purchase Agreement, it is on page 2, section 2b and 2c: Loan Contingency: Buyer’s obligation to complete this sale is contingent upon Buyer obtaining loan approval without Prior to Document (“PTD”) conditions no later than three (3) days prior to the COE Date for the loan described in the AAR Loan Status Update (“LSU”) form or AAR Pre-Qualification Form, whichever is delivered later. No later than three (3) days prior to the COE Date, Buyer shall either: (i) sign all loan documents; or (ii) deliver to Seller or Escrow Company notice of loan approval without PTD conditions AND date(s) of receipt of Closing Disclosure(s) from Lender; or (iii) deliver to Seller to Escrow Company notice of inability to obtain approval without PTD conditions. Unfulfilled Loan Contingency: This Contract shall be cancelled and Buyer shall be entitled to a return of the earnest money if after diligent and good faith effort, Buyer is unable to obtain loan approval without PTD conditions and delivers notice of inability to obtain loan approval no later than three (3) days prior of COD Date. If Buyer fails to deliver such notice, Seller may issue a cure notice to Buyer as required by Section 7a and, in the event of Buyer’s breach, Seller shall be entitled to the Earnest Money pursuant to Section 7b. If, prior to expiration of any Cure Period, Buyer delivers notice to inability to obtain loan approval, Buyer shall be entitled to a return of the Earnest Money. Buyer acknowledges that prepaid items paid separately from the Earnest Money are not refundable. The loan approval contingency is one that the seller’s agent will scrutinize when first going over your offer, and for good reason. The seller will be removing his home from the market if he accepts your offer and taking a chance that your loan will come through. The longer you take to get loan approval, the longer his home is off the market. If you end up being denied the loan, the seller has lost valuable marketing time. Most contingencies work this way: Even if the contract states a time period, the buyer can choose a time frame that is more to her liking and hope the seller is OK with it.Home Inspection

The home inspection offers the buyer an opportunity to determine, through the help of a professional, if there is anything wrong with the home’s structure and major systems. It is a visual inspection only, so don’t plan on finding out if there’s something brewing behind the walls. Most inspection contingencies state that you have the right to back out of the contract if the results of the inspection aren’t satisfactory. Others may state that you can back out if the seller refuses to remedy any problems. Decide ahead of time how you want your inspection contingency worded. If the inspection turns up items in need of replacement or repair, you can ask the seller to fix the problems, to deduct the cost of the repairs from the price of the house, to credit you back the money to fix them (if the lender allows this) or you can walk away from the purchase and receive your earnest money deposit back. As stated in Arizona Association of Realtors® Residential Purchase Agreement page 5 section 6a: Buyer’s Inspection Periods shall be ten (10) days after contract acceptance. After 10& days inspection periods, Buyer has 3 options:- Accept premises as current conditions and no corrections or repairs are requested

- Premises Rejected

- Buyer elects to provide Seller an opportunity to correct the disapproved items

Sale of the Buyer’s Property

It’s often an immense juggling act to sell one house before you close on another. In these cases, buyers frequently make the purchase of the new home contingent on the successful sale of their current home. Whether a seller will accept an offer with this contingency depends on a number of factors. In a seller’s market this contingency is typically rejected. When there are few buyers competing for homes, however, sellers are more motivated to accept less-than-ideal offers. The seller’s personal situation may play into his decision as well. If he needs to sell his home quickly, he may reject your offer, or counter it, asking for the contingency to be removed from the offer.Review of HOA Documents

If the property you hope to purchase is in a community with a homeowners association, you will be provided with a mountain of documents. These include, but aren’t limited to:- Covenants, Conditions and Restrictions (CC&Rs) – These include pet policies, parking rules, rules for the use of on-site amenities, exterior décor, landscaping restrictions and more

- The HOA Budget – This includes important information about where the money goes and whether the reserve account contains enough money to meet emergencies

- HOA Board Meeting Minutes – The meeting minutes will let you take a peek behind the scenes and find out what type of issues the board generally deals with, what actions they have taken against homeowners, and if there has been any discussion about raising fees or levying special assessments

- Governing Documents – Sometimes called bylaws, these documents let you know how elections are run, how a homeowner can go about getting a seat on the board, and the length of each member’s term. You’ll need the time to read through each document carefully, especially to determine if there is any pending litigation against the HOA or the developer. If there is, your lender may deny the loan. Ensure that you are provided adequate time to either read the paperwork yourself or have your lawyer go over it.

Appraisal Contingency

Unless you are paying cash for the home, the appraisal contingency is second in importance only to the loan approval contingency. The appraised value of the home represents the maximum amount of money the lender will give you. Per Arizona Association of Realtors® Residential Purchase Agreement, it is on page 2, section 2l: Appraisal Contingency: Buyer’s obligation to complete this sale is contingent upon an appraisal of the Premises acceptable to lender to at least the purchase price. If the Premises fails to appraise for the purchase price in any appraisal required by lender, Buyer has five (5) days after notice of the appraised value to cancel this Contract and receive a refund of the Earnest Money or the appraisal contingency shall be waived. If the lender’s appraiser determines that the home isn’t worth what you’ve agreed to pay for it, you have several options:- Ask the seller to lower the home’s price to the appraised value

- Increase the amount of your down payment to reduce the loan amount

- A combination of the first two; the seller reduces the price and you add more cash to meet the appraised amount

- Ask for a new appraisal. This only works if the appraiser made mistakes or if you or the seller can add information that the appraiser didn’t take into account

- Walk away from the purchase

- Your real estate agent is your best source of information on the various contingencies in a real estate contract. Follow your agent’s advice about staying on task during the process so that you can formally remove the contingencies by the dates specified.

Buyer Disapproval of Seller’s Property Disclosure Statement

Per Arizona Association of Realtors® Residential Purchase Agreement, it is on page 4, section 4a: Seller Property Disclosure Statement (SPDS): Seller shall deliver a completed AAR Residential SPDS form to Buyer within three (3) days after Contract acceptance. Buyer shall provide notice of any SPDS items disapproved within the Inspection Period or five (5) days after receipt of the SPDS, whichever is later.Buyer Disapproval of Insurance Claim History

Per Arizona Association of Realtors® Residential Purchase Agreement, it is on page 4, section 4b: Insurance Claim History: Seller shall deliver to Buyer written five (5) year insurance claim history regarding the Premises (or a claims history for the length of time Seller has owned the Premises if less than five (5) years from Seller’s insurance company or an insurance support organization or consumer reporting agency, or if unavailable from these sources, from Seller, within five (5) days after contract acceptance. Buyer shall provide notice to any items disapproved within the Inspection Period or five (5) days after receipt of the claim history, whichever is later.Swee Ng, Realtor and Phoenix East Valley resident specializing in win-win real estate transaction through great communication and fighting for his clients’ best interest. After all, this is more than real estates, this is about your life and your dreams.

If you are looking to buy or sell your home in Chandler AZ and surrounding area, we hope you will consider us. contact us today for complimentary consultation.

New Listings Homes for Sale Chandler AZ

Search and View Your Dream Home

Receive email alert as soon as a Chandler property matching your criteria hits the market. Be one of the first to see new listings. Simply type in everything you want in a house and save your search here to be notified.

Disclosure

All data relating to real estate for sale on this page comes from the Broker Reciprocity (BR) of the Multiple Listing Service, Inc. Detailed information about real estate listings held by brokerage firms other than Real Estate include the name of the listing broker. Neither the listing company nor Real Estate shall be responsible for any typographical errors, misinformation, misprints and shall be held totally harmless. The Broker providing this data believes it to be correct, but advises interested parties to confirm any item before relying on it in a purchase decision. Information contained herein is deemed reliable but not guaranteed.

Swee Ng is a participant in affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising. Swee Ng has affiliate relationships with other companies, people and brands and when you click a link and make a purchase, he may receive a direct benefit.